The revolution in electric micro-mobility is happening all over the world, but it is happening at varying speeds and in diverse ways around the globe. Although most news outlets focus on the competition between Tesla and BYD to gobble up the market of the legacy auto companies, and the latest EV startups to crash and burn, the changes in micro-mobility happening on the ground around the world are far more interesting and exciting in my opinion.

Unfortunately, it is hard to keep track of what is happening, since much of it doesn’t make headlines and is often poorly reported. I thought it was worth summarizing some of the trends in electric bicycles that I see globally and observing how I think they will translate in the future to developing countries like Bolivia where I have lived for the last 17 years. What happens in places like China, Europe and North America does reverberate in the rest of the world, but how that plays out on the ground is often unexpected and worth our attention.

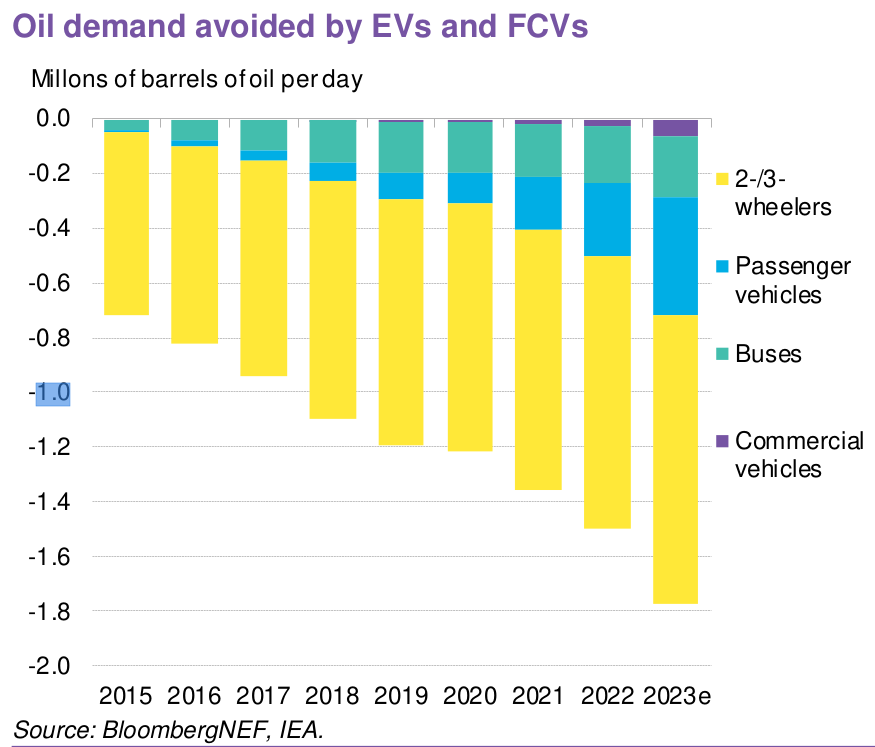

BloombergNEF estimates that over 280 million electric mopeds, scooters, motorcycles and three-wheelers were on the road worldwide in 2022, compared to 20 million electric passenger vehicles and 1.3 million commercial vehicles (buses, delivery vans and trucks). All those electric 2 and 3 wheelers cut global demand for petroleum by roughly a 1.08 million barrels per day, which represents 1% of the world’s total demand. Although 4 wheeled electric vehicles garner all the headlines, as evinced by the recent media firestorm surrounding Tesla’s release of the Cybertruck, Bloomberg calculates that the adoption of 2 and 3 wheeled electric vehicles has reduced global petroleum consumption three times more than the adoption of passenger electric vehicles.

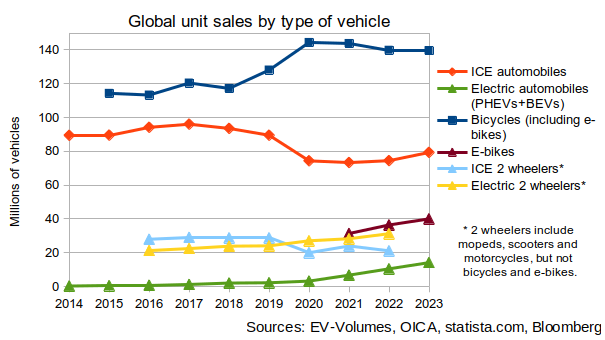

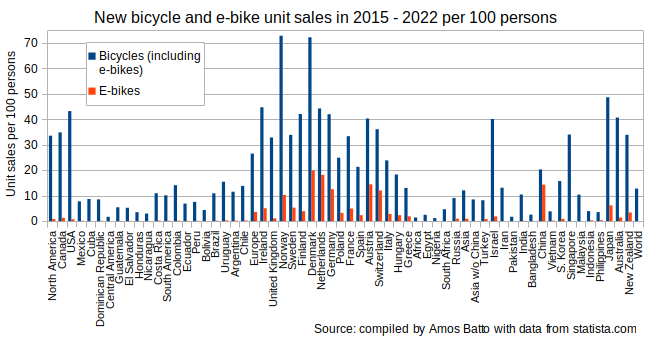

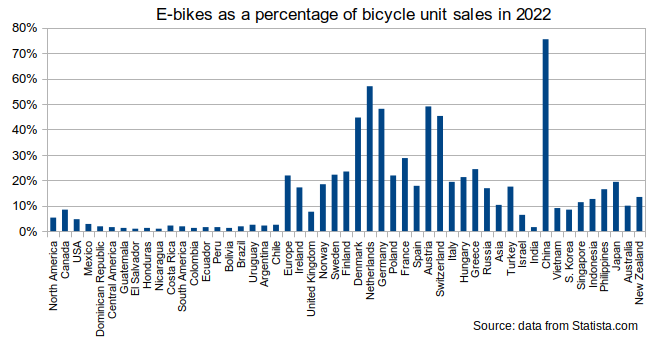

Bloomberg doesn’t include bicycles in its calculations, but they are also helping to move people out of traditional internal combustion vehicles. A recent market study estimates that 139.8 million bicycles were sold worldwide in 2022, which is a significant growth over the 114.3 million bicycles sold in 2015. What is surprising is how many of those bicycle sales are now electric models. According to one estimate, 36.5 million electric bicycles (i.e “e-bikes”) were sold worldwide in 2022, meaning that one out of every four bicycles was electric. In China, 75.5% of new bicycles are estimated to be e-bikes, and in some high-income countries, such as the Netherlands, Belgium, Germany and Japan, over half of new bicycles are now electric. Considering that roughly three e-bikes are sold worldwide for every electric vehicle (EV), we should be paying more attention to their growing impact.

The drop in the sales of new ICE automobiles from 96.04 million in 2017 to 74.49 million in 2022 is often attributed to the rise of electric automobiles, but ICE vehicle sales dropped by 6.53 million units between 2017 and 2019, whereas only 2.28 million electric automobiles were sold in 2019. Likewise, there was a drop of 21.55 million ICE automobiles between 2017 and 2022, but only 10.52 million electric automobiles were sold in 2022. There are many factors to explain the decreasing ICE sales, such as the rise of ride services such as Uber and DiDi, the increasing use of internet chat and virtual meetings, and the fact that younger generations are driving less and buying fewer cars than previous generations, but a large part of the story is the increasing use of two wheeled vehicles in place of cars.

Global sales of electric scooters and motorcycles surpassed ICE scooters and motorcycles in 2020, but total sales of scooters and motorcycles has basically stayed flat over the last decade at about 50 million units per year. What has changed, however, are the rising sales of bicycles, and especially electric bicycles. The increased demand for bicycles at the same time that ICE vehicle sales fell suggests that bicycles played a substantial role in helping to move people out of ICE vehicles. Mike Radenbaugh, the founder of Rad Power Bikes, which is the largest e-bike seller in North America, claims that “in more than 70% of Rad Power customers, their primary reason for adopting an electric bike into their life is to replace car miles.”

E-bikes have long been popular in China, although many of them are more properly termed “electric scooters,” since they only need to have pedals (or provisions for pedals) to be classified as “e-bikes” in China. Many of them have wide floorboards, so they would be hard to actually pedal, so most people ride them as scooters using just the throttle. At the end of 2002, the Chinese Ministry of Transport issued a new regulation that “motorcycles on the road require a driver’s license,” which led to a boom in people riding e-bikes to get around the regulations. Most of these e-bikes were made with heavy lead-acid batteries and had a secondary seat for another passenger on the back, so they would have been difficult to propel with just pedal power, but they were nice economical vehicles for short distance trips that got around the onerous licensing requirements for motorcycles. Many of the e-bikes sold in China should be classified as scooters or mopeds since throttle driven. The World Bicycle Industry Association estimates that only 32% of the e-bikes (9.7 million of 30 million) sold in China in 2021 had pedal assistance, so the majority of China’s e-bikes are being driven by throttle.

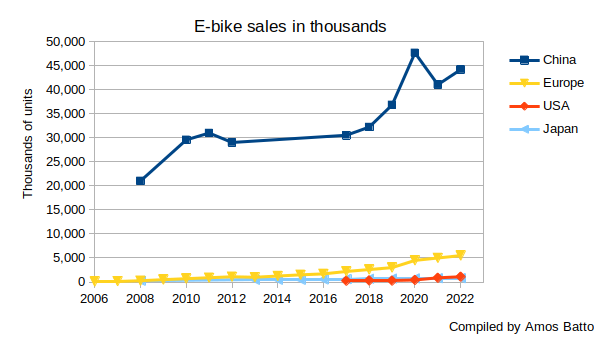

In 2009, China manufactured 22.2 million e-bikes, of which only 370,000 or 1.7% were exported. The China Bicycle Association estimated that 31 million new e-bikes were sold in China in 2011, compared to 1.23 million in Europe, 409k in Japan, 80k in the USA, 79k in India, 33.5k in Taiwan and 50k in Southeast Asia. The number of e-bikes on Chinese roads has grown quickly, from an estimated 120 million in early 2010, to 200 million in late 2013, to 250 million in late 2018, and to 300 million in 2020.

This boom in e-bikes helped contribute to the congestion of China’s already clogged streets, and many e-bikes were not riden safely. A study conducted between October 2010 to April 2011 found that e-bikes were involved in 57% of the serious nonfatal road accidents in a rural hospital in Suzhou, and 36% of those injured e-bike riders had traumatic brain injuries.

Many Chinese cities have restricted and even banned the use of e-bikes. In 2006, Guangzhou attempted to ban e-bikes on its roads in order to stimulate its growing auto industry, which led to protests by the city’s 100 Chinese e-bike manufacturers. By late 2009, ten Chinese cites had either banned or imposed similar licensing restrictions on e-bikes as motorcycles, including Guangzhou, Shenzhen, Changsha, Foshan, Changzhou and Dongguang.

In April 2019, the Chinese national government imposed sweeping new regulations on e-bikes that limited their maximum weight to 55 kg, their speed to 25 km per hour, their motors to 400 watts and their battery voltage to 48 volts. In a big brother-style move, they even required that the bikes give a warning when exceeding 15 km/hour. In May 2020, the Zhejiang and Jiangsu Provinces made wearing a helmet mandatory when riding an e-bike, and Shanghai followed suite in May 2021. Those regional requirements to wear helmets with e-bikes extended nationwide starting in July 2023. Many cities, including Beijing, Shanghai and Shenzhen now require e-bikes to be registered and have a license plate, and Guangzhou is again considering banning e-bikes despite the fact that there are 3.6 million licensed e-bikes in the city.

Despite all these restrictions on e-bikes in China, they surged in popularity during the COVID-19 pandemic, as e-bike sales in China increased from 32.2 million in 2018 to 47.6 million units in 2020. People were leery of taking public transport during the pandemic and the restrictions on movement led many to consider buying an e-bike. The surge in demand was abetted by the massive improvements in weight and performance offered by lithium batteries that had finally become cheap enough to replace the clunky lead-acid batteries used in many Chinese e-bikes.

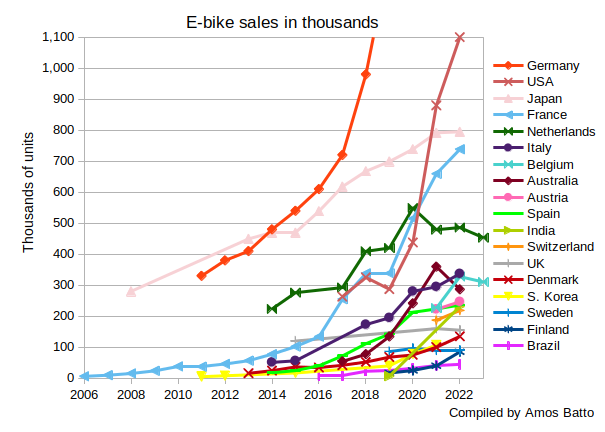

The surge in demand for e-bikes during the pandemic was even more dramatic in some other parts of the world. European e-bike sales, which were traditionally concentrated in countries like the Netherlands, Germany, Denmark, Austria, Belgium and Sweden, began to spread rapidly to other countries like France, Italy, Spain and Finland. A number of cities such as Paris and Minneapolis/St. Paul began to implement polices and urban redesign similar to Amsterdam and Copenhagen to become more bike-friendly.

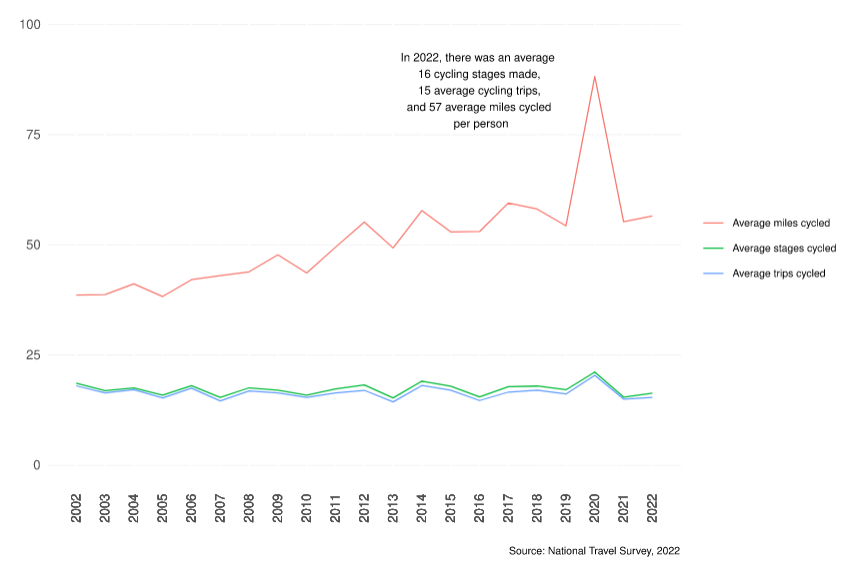

At the same time, the pandemic caused people who were isolated and idle to crave more outdoor activity, causing increased interest in biking in general. The UK’s Department for Transport reports that average number of miles cycled per person per year in England has gradually increased from 39 miles in 2002 to 54 miles in 2019, showing increased interest in cycling. However, average cycling per person spiked to 88 miles in 2020 during the COVID-19 pandemic. Much of this increase in cycling was recreational, rather than commuting. The statistics also show that the English are taking longer trips on their bicycles, which can be aided by the electrification of cycling. The Department of Transport also found in surveys that the percentage of people age 5 or older with access to a bicycle rose from 42% in 2017-19 to 47% in 2020 during the pandemic. According to Sport England, the number of English who cycle at least twice per month increased from 5,044,400 in 2016 to 6,479,900 in 2021–an increase of over 28%. What is surprising is that these changes happened in the UK, where a lower percentage of the population owns bicycles than in most European countries.

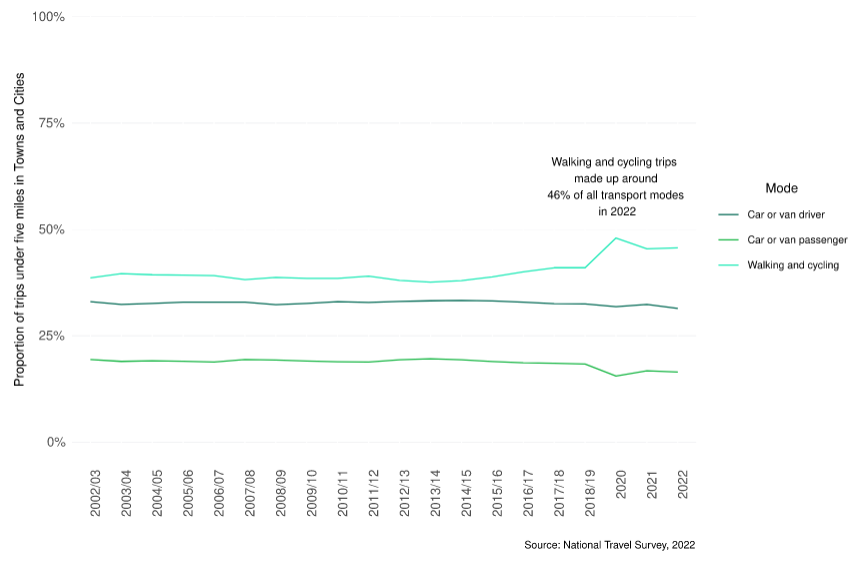

Even more hopeful is the fact that the pandemic caused more English to take trips on foot or by bicycle. Between 2002 and 2019, the proportion of urban trips under 5 miles by walking or cycling varied between 38% and 41%, but that percentage spiked to 48% in 2020. After the pandemic ended, that percentage stayed higher at 46% in 2022, showing that the pandemic helped get more people accustomed to walking and cycling. The belief that humans are unwillingly to change how they travel is belied by these numbers, which is a hopeful sign of our ability to adopt greener mobility in the future.

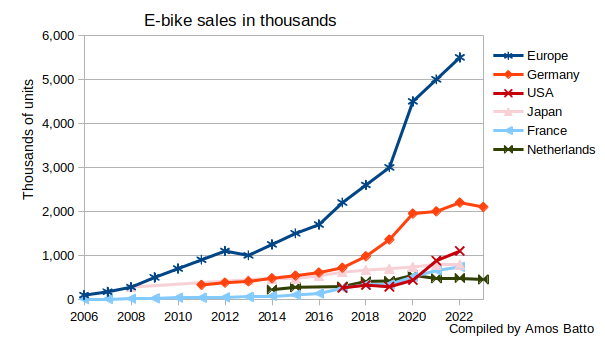

Even though inflation from global supply chain shortages and increased demand raised the average e-bike price in Europe from €1955 in 2018 to €2736 in 2022, Europeans still bought e-bikes in record numbers. Sales of new e-bikes in Europe grew from 2.6 million units in 2018 to 5.5 million in 2022.

Much of the recent growth in e-bike sales has been happening in new markets, such as the USA, France, Italy, Australia, Spain, India and South Korea, where e-bike ownership has been historically limited, and many of these countries don’t have particularly high rates of cycling. The growth is particularly striking in countries like the US and Australia whose infrastructure is overwhelming designed for private cars. A recent survey by eBikes.org found that 15% of Americans now own an e-bike. It is unlikely that eBikes.org got a representative sample of Americans in its survey, but the number of e-bike riders has definitely exploded in the U.S. The growth of cycling, which has been partly aided by the advent of e-bikes, is one of the more hopeful signs for the future of transport.

| New electric bicycle and total bicycle sales in 2022 | ||||||

| Country | E-bike sales (1000s) | Bicycle sales (1000s) | E-bike annual growth | % e-bike of bicycle sales | E-bikes sales / 1000 persons | Bicycle sales / 1000 persons |

| China | 44 150‡ | 43 000 | 7.7% | 75.50% | 31.0 | 30.2 |

| Japan | 795 | 1 492 | 0.4% | 53.3%* | 6.4 | 12.0 |

| S. Korea(2021) | 107 | 1 500 | 37% | 7.1% | 2.1 | 28.9 |

| India | 231.3 | 20 290 | 1.1% | 0.2 | 14.3 | |

| Australia | 287 | 1 372 | -20% | 20.9% | 10.9 | 52.4 |

| Germany | 2 200 | 4 600 | 10% | 48% | 26.4 | 55.2 |

| France | 738.5 | 2 596 | 12.0% | 28.4% | 11.4 | 40.2 |

| Spain | 236.2 | 1 357 | 5.6% | 17.6% | 5.0 | 28.5 |

| Netherlands | 486 | 855 | 1.5% | 56.8% | 27.7 | 48.7 |

| Belgium | 327.8 | 696 | 44.9% | 47.1% | 28.1 | 59.7 |

| Italy | 337 | 1 772 | 14.2% | 19.0% | 5.7 | 30.0 |

| UK | 155 | 2 035 | -3.1% | 7.6% | 2.3 | 30.1 |

| Austria | 246.7 | 506 | 11% | 48.75% | 27.6 | 56.6 |

| Switzerland | 218.7 | 484 | 17% | 45.23% | 25.0 | 55.3 |

| Denmark | 135 | 545 | 35% | 24.77% | 23.0 | 92.7 |

| Sweden | 90 | 430 | 0% | 20.93% | 8.5 | 40.8 |

| Finland | 85 | 415 | 113% | 20.48% | 15.3 | 74.9 |

| Europe | 5 500 | 24 000 | 10% | 22.9% | 7.4 | 32.3 |

| USA | 1 100 | 17 700 | 25% | 6.2% | 3.3 | 52.3 |

| Brazil | 44.8 | 3 770 | 9.6% | 1.2% | 0.2 | 17.5 |

| World | 36 464† | 143 000† | 16.1% | 25.5% | 4.6 | 17.9 |

| ‡ The 44.15 million in e-bikes sales probably includes some throttle-driven e-scooters, which is why e-bike sales are higher than total bicycle sales. * Stats from Japan’s Ministry of Economy, Trade and Industry, but Statista.com estimates that e-bikes were 19.4% of Japan’s bicycle unit sales in 2022. † The global estimates of e-bikes and bicycles by Statista.com probably includes throttle-only e-bikes from China, which other countries wouldn’t classify as e-bikes and bicycles. Source: Compiled by Amos Batto from many sources, listed in the spreadsheet at the bottom of this article. | ||||||

Unlike the growth of electric vehicles (EVs), the vast majority of this growth in e-bike sales has happened without public subsidies for the purchaser or manufacturer. The growth would have been undoubtedly greater if e-bikes were subsidized like EVs have been. Sweden provides an example of the effect that subsidies can have on a market. Between September 2017 and September 2018, Sweden offered a 25% subsidy (up to €1000) on the purchase price of e-bikes, which caused sales of e-bikes to grow by 50% to 103,000 units in a year. After the subsidy was removed, sales dropped by 16.5% to 86,000 units in the following year, but sales have remained at that level, selling 90,000 units in both 2021 and 2022, so the subsidy appears to have permanently increased demand for e-bikes in Sweden.

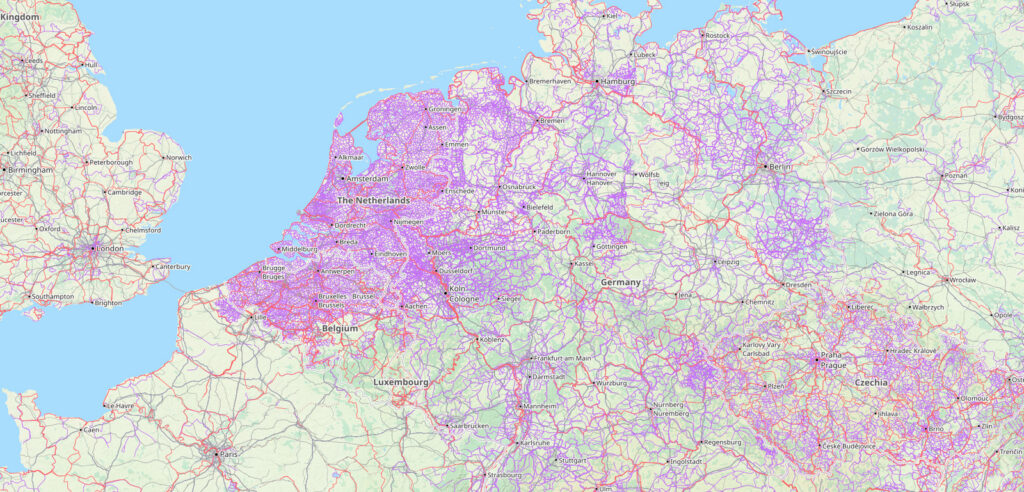

Of course, the most important way to subsidize e-bikes is to build public bike paths, add bike lanes to streets and redesign cities to make cycling safer and more convenient. The Netherlands has pursued a policy of good urban design to encourage cycling ever since Delft demonstrated the idea of creating a network of cycling paths through out the city in the 1980s. Today the Netherlands has 1.36 bicycles per person which is the highest amount per capita in the world. The country has constructed the Dutch National Cycle Network, containing 35,000 km of bike paths, which is a quarter of the length of the nation’s 140,000 km road network for automobiles. 27% of all trips in the country and 38% of trips in Amsterdam are taken via bicycle, compared to just 2% in the UK. Comparing the density of bicycle paths in the Netherlands versus surrounding countries, it becomes clear why the Dutch have adopted cycling at higher rates than their neighbors.

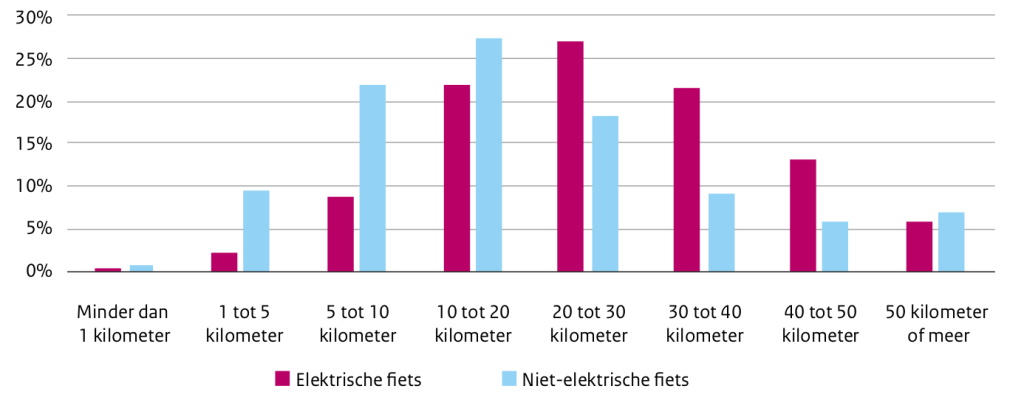

A 2022 survey by the Dutch government found that 29% of cyclists in the Netherlands use electric bicycles. 70% of Dutch e-bike riders say that they use e-bikes “to make cycling easier”, and that percentage was even higher for elderly people, people with disabilities and people who do not live active lifestyles. Only for e-bike riders between the ages of 12 and 17 years old was the primary reason given to use an e-bike to “cycle faster,” which was the answer given by 60% in that age group. The survey also found that the likelihood of using an e-bike increased with the length of the trip. The majority of Dutch riders who have to travel 10 or more km to school or work, or 20 or more km for other uses (shopping, visiting friends, touring, etc) use an electric bicycle, whereas the the majority who travel shorter distances do not.

Many riders of traditional bicycles consider e-bike riding to be “cheating”, since much of the work is done by the electric motor. An e-bike rider expends 15% to 25% less body energy (depending on the level of pedal assistance) to go the same route as a rider of a manual bicycle. A study in Utah found that e-bike riders had a average heart rate of 145 beats per minute, which was 94% of the manual bicycle riders, who averaged 155 bpm. Another study found that e-bike riders had 12% less lung activity when riding, utilizing 51% of their lung capacity versus 58% capacity for pedal cyclists. Their level of physical exertion is less intense, but e-bike riders typically ride for longer, so they end up spending more time exercising which has long-term cardiovascular benefits. A study of 10,000 riders in 7 European cities (Antwerp, Barcelona, London, Örebro, Rome, Vienna and Zurich) found that the average daily travel of e-bike riders was 8.0 km, compared to 5.3 km for manual bicycle riders. Given that e-bike riders tend to be older and less physically fit than normal cyclists, e-bikes provide exercise for people who are less inclined to get exercise.

Aside from the health benefits, there is the vital question of whether e-bike riding is detrimental to the environment, since it is substituting an electrical motor for human legwork. Most e-bikes are charged using electricity which comes from the grid. Fossil fuels generated 59.9% of global electricity in the first half of 2023, so most of the world’s e-bikes are being powered by the burning of gas and coal in thermoelectric generators which emit greenhouse gases.

Even if using 100% renewable energy to charge e-bike batteries, there are still ecological costs to the manufacturing of the batteries, motors, controllers, displays and beefier frames and brakes used by e-bikes. Most e-bikes have brushless DC motors containing copper windings and permanent magnets made of neodymium and dysprosium or praseodymium, which are metals whose mining and refining exact heavy ecological tolls. Almost none of the energy and chemical inputs consumed in the fabrication of the electronics in the controllers and displays can be recovered by recycling, aside from trace metals in the circuit boards. The mining and refining of the nickel, cobalt, manganese, lithium, copper and aluminum used in e-bike batteries is polluting, and a great deal of energy is consumed in the drying beds of battery factories. A review of the LCA studies concluded that a lithium ion battery produced in China emits a median of 156.9 kg CO2-e per kWh, so manufacturing a typical 0.5 kWh e-bike battery would emit 78.5 kg CO2-eq.

On the other hand, brushless DC motors are very energy efficient compared to ICE motors which lose 60% of the energy as heat when combusting gasoline. Gasoline cars are only 12%-30% energy efficient, whereas one study measured 82% energy efficiency for an e-bike. Cycling is a very energy efficient form of transportation, with 98.6% of the cyclist’s pedal effort used to spin the wheels. On a caloric basis, cycling on a flat surface is 4 times more energy efficient than walking and 5 times more energy efficient than running. However, cycling becomes very inefficient when going uphill. On a 2% – 3% grade, it takes more energy to cycle than walk and 800% more force is required to cycle up a 10% grade than on a flat surface. It is precisely in going up hills where the e-bike’s motor helps make riding possible for many cyclists. On flat routes, riding an e-bike typically reduces travel times by 15% compared to a manual bicycle, but e-biking reduces the time by 35% on hilly routes.

The energy to operate an e-bike is a minor consideration. According to E-Bike Report, the average e-bike consumes 8,45 Wh per km. The average kWh in the world emits 436 grams of CO2-equivalent in its generation, which means only 3.7 grams of CO2-e is emitted per km to ride an e-bike. Even in China, where 61% of the electricity comes from coal and the average kWh emits 531 grams of CO2, that still only means 4.5 grams of CO2 per km. If we guesstimate that there are 230 million e-bikes in the world and the average e-bike is ridden 5 km per day, that would consume 3.55 TWh of electricity and produce 1.55 megatonnes of CO2-e, which would represent 0.012% of the world’s electricity and 0,003% of the world’s greenhouse gas emissions.

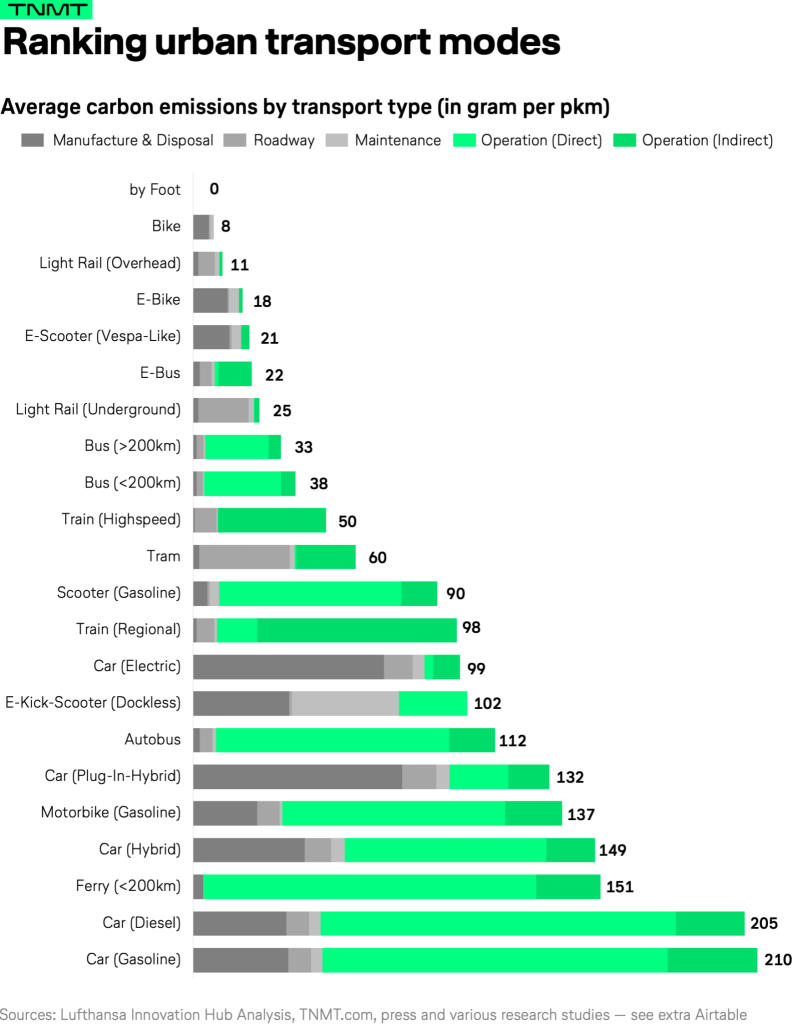

Far more significant than the operation are the emissions from the fabrication of bikes. TNMT, a research group at Lufthansa, includes the full lifecycle of different types of transport when calculating the GHG emissions per passenger-kilometer. TNMT estimates that the average e-bike emits 18 grams of CO2 per km, compared to 8 grams of CO2 per km for a traditional bicycle.

Considering that the average human on the planet emitted 6.12 tonnes of CO2-e in 2020 according to the World Resources Institute, the difference of 10 grams per km for a bicycle versus an e-bike is basically a rounding error. A person who travels 2000 km per year on her e-bike will emit 20 kg more CO2 than if she had ridden a manual bicycle, which is the equivalent of burning 8 liters of gasoline. Given that 70% of the lifetime GHG emissions for an e-bike lie in its manufacturing and disposal, the relevant question is not whether to spend the energy to charge an e-bike, but whether to buy a new one in the first place or not. According to TNMT’s calculations,1 the manufacturing and disposal of a typical e-bike emits 193 kg of CO2, compared to 87 kg of CO2 for a bicycle. I suspect that TNMT is underestimating the emissions in manufacturing batteries and electronics, but that doesn’t fundamentally change the conclusion that the environmental impact of e-bikes is significantly lower than most other forms of transport.

The best way to minimize the environmental impact of e-bikes is to use them as long as possible and fix them when they break, rather than junking them. Unfortunately, many of the Chinese brands that are now appearing online don’t sell replacement parts, so they will be hard to fix, and their lower prices often indicate that they are using cheaper components that are more likely to break. Manual bicycles can have a higher carbon footprint than e-bikes, if a person buys a new manual bike every two years versus buying a new e-bike once every 5 years, so the most important factor is how long manual bicycles and e-bikes are used when considering their environmental impact. Nonetheless, both types of bikes are far better options than driving an ICE car which emits over 20 times more than a bicycle and over 10 times more than an e-bike per km.

While there is some environmental impact in the switch from manual bicycles to e-bikes, it is worth pointing out that e-bike sales have stopped growing in the Netherlands, Germany, Sweden and Japan, which were some of the first countries outside of China to heavily adopt them. It appears that e-bike sales stop growing in those countries once they reach about 55% of the new bicycle market, because many cyclists don’t feel that they need them and prefer to ride traditional manual bikes, which are lighter and provide a more intense workout. On the other hand, many of the people riding e-bikes are elderly and people who have a physical difficulties riding a normal bike, so those people are likely to use a car with 10 to 25 times higher emissions if they weren’t riding an e-bike. ebikes.org’s 2023 survey found that 60.6% of American e-bike riders are age 45 or above and only 16.2% are under the age of 30.

Likewise, for the people who are riding e-bikes long distances and using cargo e-bikes, their alternative is usually not a manual bike, but a car which is far more polluting. The massive growth in cargo bikes in recent years, which in Germany rose from 60,100 units in 2018 to 212,800 units in 2022, would not have happened without electrification. 77.5% of the cargo bikes sold in Germany in 2022 were electric, and many cargo bike manufacturers are only offering electric models, because there is so little demand for the manual models. ebike.org’s survey found that 31.3% of US e-bike riders list “carrying cargo” as an important e-bike feature, which is why e-bikes increasingly come with an included back rack for carrying cargo. Among leading e-bike sellers in North America, Rad Power Bikes includes back racks by default in 14 of its 16 models, Aventon includes them in 6 of its 10 models, Velotric includes them in 5 of its 7 models, and Lectric includes them in 4 of its 6 models.2 In Asia, many e-bikes have an included front basket or wide foot floor board where bags can be carried, in addition to a back rack or seat.

A 2017 survey of 1796 e-bike riders in North America asked riders to name the top three reasons why they bought an e-bike. 27.7% listed “to replace car trips”, 12.6 % listed “to avoid traffic in my car” and 6.2% listed “to avoid parking hassles in my car”, which are all responses indicating that e-bikes are helping people to move away from driving cars. In addition, 15.6% listed “a medical condition reduced my ability”, 21.9% listed “to ride longer distances to places I need to go” and 14.6% listed “to carry cargo or kids”, which are all normally reasons for Americans to drive cars.

It is hard to estimate how many people around the world have switched from driving ICE vehicles to riding e-bikes, but the reduction in GHG emissions from that switch is undoubtedly greater than the increase in GHG emissions from people switching from manual bicycles to e-bikes. The 2017 survey of North American e-bike riders found that 67.0% agreed that “it is important to reduce the amount of car trips I take or fuel I use.” 63.9% in the same survey reported that they “consciously conserve battery power” when riding, which is an indication that they are trying to only use the motor when it is necessary. Even for riders who are riding their e-bikes with just the throttle like an e-scooter, it is important to realize that the emissions of e-scooters are only slightly higher than e-bikes. TNMT calculates that a Vespa-like e-scooter only emits 21 grams of CO2 per km, which is only 3 grams more than an e-bike.

E-bikes also offer important socie-economic benefits, especially for people of limited economic means. The price of the average new car is $47,401 in the US, €44,640 in Germany and 127,000 yuan (US$17,872) in China, whereas the typical new e-bike costs costs about $1500 in the US, €2736 in Europe and 3500 – 3800 yuan (US$493 – US$535) in China. Ebikes.org estimates that a American will typically spend $21 per year to charge an e-bike, whereas the average American spends $2635 per year on gasoline.

Because there is limited public transportation in many parts of the world, there needs to be cheaper alternatives to driving a private ICE vehicle. In much of the developing world, ICE motorcycles and scooters are commonly used in place of ICE cars, but the gasoline to fuel them is a substantial burden on limited incomes. In contrast, the electricity to charge an electric two wheeled vehicle is a fraction of the cost of gasoline. ICE motor bikes stop working once the fuel runs out, whereas e-bikes can still be pedaled, so they are the best option for people with precarious incomes who shouldn’t be forced to choose between mobility and the essentials (food, shelter, medicine, etc.). E-bikes have become a favored means of transport for younger people in cities with precarious economic prospects, because they are substantially cheaper and more convenient than other options. The cost of a new e-bike is often less than a couple months of riding public transport in European cities or buying a cheap used car in North America.

For places, such as the vast majority of the USA, Canada and Australia, which are built around private cars, they effectively exclude those who don’t drive from participating in society when they don’t have their own means of private transport. Roughly 30% of Americans don’t drive, which means that millions of Americans have trouble getting to work, shopping, attending social events, etc. The increased social inclusion that e-bikes offer for people who can’t get driver’s licenses or can’t afford cars has incalculable value for society. Of course, e-bikes are only a partial solution, since many are physically unable to ride them or are too young to legally ride them, but they do open doors for many people, especially in places that don’t have adequate public transportation and the infrastructure is designed for private vehicles.

The boom in e-bikes has also been spurred by the evolution of the bikes to become more diverse, more stylish and fill more niches in the market, so they appeal to more people. Traditionally, most e-bikes in Western countries were converted road bikes and mountain bikes, and they were mostly used by people who were already bike riders. Strapping a bulky battery onto a thin bike frame, however, unbalanced the bike and was not aesthetically appealing.

The first prototype that Yamaha built of an electric bicycle in 1989 had the battery bolted into a unified top tube and down tube, so the battery appeared to be incorporated into the frame. Yamaha, however, decided to release the world’s first production pedal-assisted electrical bike in 1993 with a separate battery placed behind the seat tube. Most e-bike manufacturers followed Yamaha’s example, using separated batteries which were placed either behind the seat tube or attached to the down tube.

In recent years, however, there has been a growing movement to incorporate the battery into the bike’s frame, which has become increasingly possible with the greater energy density of lithium ion batteries compared to the bulkier lead acid, nickel cadmium and nickel-metal hydride batteries used in the past. Many e-bike manufacturers now use an enlarged down tube where the battery can be popped into the frame, which makes the bicycle look sleeker and more visually appealing than carrying a separated battery

Dutch e-bike maker VanMoof took the idea of incorporating the battery into the frame even farther when it released its 10 Electrified in 2014, with the 209 Wh battery completely enclosed inside the frame. VanMoof’s in-frame battery was so long and narrow that the bike appeared to have no battery at all. The benefit of an in-frame battery is that it is better protected from the rain and harder to steal, but it is also harder to replace and can’t be taken off the bike to be separately charged.

Many bike manufacturers have started using in-frame batteries placed inside a folding frame, which provides an easy way to remove the battery. The battery is protected from the elements and thieves when the bike is unfolded, but the battery can be accessed by folding the frame and pulling out the battery. Many bike manufacturers have starting using thick, rectangular down tubes to hold these in-frame batteries in their folding bikes. Having to fold the bike to get to the battery isn’t as convenient as having a pop-out battery in the frame, but it better hides the battery and is a good option for people who want more protection for their batteries.

Electrifying bikes made it possible for them to use much wider wheels, commonly known as “fat tires”. Although fat tire bikes were already available for specialized bikes designed to be ridden on snow, beaches and desert sands, they were not very popular because they had too much rolling resistance and it took a lot of physical effort to pedal them. Surley, a bike maker from Minnesota, introduced the Pugley in 2005 with 3.7″ wide tires, which was the first fat tire bike to be commercially produced. Although brands like Mongoose made fat tires popular among a select class of biker riders, fat tire bikes remained a niche product until they started to be paired with electric motors, which eliminated much of the physical effort of riding them.

Electrification allowed anyone to ride on wider tires with deeper thread that were less likely to slip and slide on wet, icy, sandy and rocky surfaces. The extra force of a motor made it easier for people to ride on thicker and under-inflated tires that were better able to absorb the bumps in the road. The wider tires also made people more confident to ride at higher speeds and on more dangerous surfaces, so bikes could be used in more places.

Folding bikes have long been a niche product used by urban commuters in Western Europe, ever since Andrew Richie produced his first Brompton bike in 1981 and Dr. David Hon produced his first Dahon bike in 1982. However, the need to fit into tight spaces required using 20 inch or smaller wheels, and the requirement to be as light as possible eliminated many features like fenders, racks, chain guards, suspension forks, comfortable seats, wider tires, etc. which riders wanted. Many bike riders didn’t care for the limited number of gears, slower speeds and greater instability of folding bikes. However, an electric motor made it possible to use folding bikes that included many of the desired features, because the motor could push the heavier weight and move a folding bike faster even if it had fewer gears and smaller wheels. Adding heavy features like wider tires, suspension and wider seats made folding bikes more comfortable to ride.

The transformation of the Brompton C folding bike (26.7 lbs, 16×1.35″ tires, 2 speed, caliper brakes, 242 lbs max weight) into the Lectric XP folding e-bike (64 lbs, 20×3″ tires, 7 speed, hydraulic disk brakes, 330 lbs max weight)

Electrification has helped drive the popularity of folding bikes. Today there are more people riding folding e-bikes with wide tires, such as the RadExpand, Aventon Sinch.2 and Lectric XP, than riding traditional folding bikes, such as the Brompton C line, Dahon Mu D8 and Tern BYB P8. Lectric claims that its folding XP with 20″ x 3″ fat tires and a front suspension fork is the most popular e-bike model in North America. It is hard to verify this claim, but the folding XP certainly helped propel the new bicycle company that was founded in 2018 into the front ranks of the American bike industry.

What is interesting is that some of the most passionate buyers of these folding fat tire e-bikes are owners of RVs (recreation vehicles) who need bikes to get around a campground. They are often older people who want to avoid the physical rigor of pedaling a normal bike and they appreciate the greater safety and comfort of fat tires. They are far from the London commuter carrying a folding Brompton to work or the mountain bikers riding fat tires on desert sands, but the merging of those features makes the perfect bike for their needs.

Another transformation caused by electrification has been the growing popularity of cargo bikes. While cargo and utility bikes have been used since the 1890s, the physical effort to pedal them when loaded down with tools, kids, groceries, etc. limited their appeal. However, the addition of electric motors made cargo bikes an attractive option for many people who wanted to get out of their cars, but didn’t have the physical strength and stamina required for a traditional cargo bike.

In Europe, electric motors have increased the appeal of three wheeled cargo carriers such as the Christiania trike in Copenhagen, but it has had even more impact on the popularity of the two wheeled bakfeit and Long John bikes. Electric bakfeits are becoming very common in the Netherlands, and widely used for carrying kids. There is a growing tendency for Germans to buy secondary bicycles for specialized uses such as carrying cargo. Since 2021, the German government has offered a subsidy up to €2500 for cargo bikes and cargo trailers for business use, which has helped spur sales of cargo bikes. In 2022, cargo bikes represented 4.6% of the German bicycle market and 8% of its electric bike market. Market analyst firm Mordor Intelligence predicts that Europe’s e-cargo bike market will be US$1.05 billion in 2024 and grow to US$1.60 billion by 2029.

In European countries with a rich biking culture, it is not surprising that electrification would induce more people to replace their polluting ICE cars with greener electric cargo bikes. What is surprising, however, is the number of people in car-dominated America who are now using cargo bikes for many of the tasks that used to require a car.

Unlike in Europe where cargo bikes generally have boxes or flat beds placed in front of the rider, the US developed bikes with long back racks called “long-tails” to carry cargo or kids. Ross Evans developed the idea of a long-tail cargo bike in 1995 while working on a Bikes Not Bombs project in Nicaragua for people who needed to carry their products to market. Returning to the US, he founded Xtracycle in 1998 to commercialize a bolt-on back attachment called the “Free Radical” to convert normal bikes into long-tailed cargo bikes. In 2008, Xtracycle asked Surley Bikes to create a complete long-tail bike which was sold as the “Big Dummy” and then released the specs for their long-tail frame as an open source standard to spur other bike manufacturers to create attachments such as child seats, back racks and foot running boards based on that standard. A number of bike makers took Xtracycle’s specs and created their own compatible long-tailed models.

Unlike other types of cargo bikes, long-tail cargo bikes ride like a normal bike, and are not much heavier than a normal bike. The cost to produce long-tails is also substantially lower than other types of cargo bikes, since it just involved extending the frame. The long-tail back rack with a padded bench, protective cage and foot running boards proved to be very popular with parents who needed an easy way to transport their kids. XtraCycle, Tern and Yuba offered electric long-tail cargo bikes for over $4000, but they were niche products until Rad Power Bikes released the RadWagon with a 500 watt hub motor in 2015 for $1800, which dramatically increased their popularity. They spread across the pond to Europe. It took a while for this new type of bike to catch on, but long-tail cargo bikes cost a lot less than Long John-style bikes, which has helped the long-tail sales to explode in recent years in Europe. In 2023, sales of long-tail cargo bikes in Belgium doubled over the previous year, selling 6328 units, which represents 1.04% of the Belgian bicycle market.

Cargo bikes with a shorter back rack were also developed, which have become known as a “mid-tail cargo bikes” or “utility bikes”, and they are becoming very popular among riders who want carrying capacity, but still want a bike with normal dimensions and handling. A number of bike brands, such as Velotric, Specialized, Tern, Benno, Xtracycle and Rad Power now offer both mid-tail and long-tail models.

Electrification has also caused the adult tricycle to explode in popularity. Many older people and people with physical limitations do not feel capable of maintaining the balance or leg power required to ride a two wheeled bike. Electric tricycles have become a popular mobility device in recent years, and most of the major bicycle brands now offer e-trike models. They have to be ridden at lower speeds, since they have a tendency to tip when turning at high speeds and many bike riders find their handling awkward, but many people with limited mobility gush about how they have enabled them to get out and enjoy the world again and how convenient they are for carrying groceries. E-trikes used to cost over US$3000, but Lectric has dramatically lowered their prices in the US by releasing its folding XP Trike in August 2023 for just $1499 with a 500W hub motor powering a differential back axle.

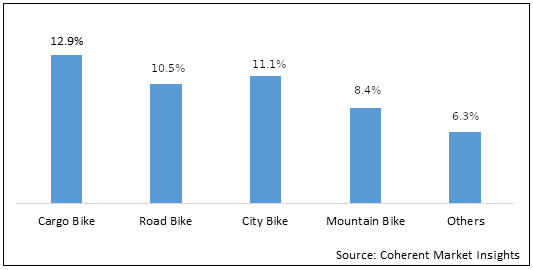

The impact of electrification can be seen in the types of e-bikes that are now being sold. Whereas cargo bikes were a very niche type of bicycle before electrification, Coherent Market Insights estimates that the cargo bike was the most common type of e-bike sold in Europe in 2021, with 12.9% market share. The second most common type of e-bike was the urban bike, which presumably includes folding bikes like the Rad Power RadMini, Lectric XP and Aventon Sinch.2. The mountain bike, which is the most common type of manual bike is the least popular type of e-bike.

In Europe most people still buy their e-bikes at traditional bike stores. Only 25% of German bicycle sales by revenue in 2023 were online. Most e-bikes sold in Europe come from older brands that sell both manual bikes and e-bikes. According to Mordor Intelligence, the top e-bike brand in Europe is Giant (Taiwan, 1972) with 25.01% market share in 2022. It is followed by Kalkhoff Werke (Germany, 1919), Riese & Müller (Germany, 1993), Trek (USA, 1975) and Yamaha Motors (Japan, 1955). Together these 5 companies control 44.88% of the European e-bike market, leaving the rest to companies, such as Accell Group (Netherlands, 1998), Brompton (UK, 1976), Fritzmeier (Germany, 1926), KTM (Austria/India, 1934), Merida (Taiwan, 1972), Pedego (USA, 2008), Gazelle (Netherlands, 1892), Swiss E-Mobility (Switzerland, 2018), VanMoof (Netherlands, 2009) and Volt (UK, 2010).

In contrast, The North American e-bike market has more direct-to-consumer brands which both sell online and offer their models through bike shops, where people can get them serviced. Many of these brands are new American companies, such as Rad Power Bikes (2007), Pedego (2008), e-JOE (2008), Aventon (2012), HeyBike (2015), Himiway (2017), Lectric (2018), KBO (2018), Ride1Up (2018) and Velotric (2020), that specialize exclusively in e-bikes. The 2017 survey of North American e-bike riders found that 35.6% had purchased their e-bike online and that percent is undoubtedly higher today. 70.92% of American e-bike riders reported purchasing their e-bikes online in a 2019 survey (but that survey was distributed through an email group online so it probably isn’t representative).

The e-bike company that claims to be “pioneers of the direct-to-consumer ebike movement” is Seattle-based Rad Power Bikes. The company’s founder, Mike Radenbaugh, started the company in 2007 by adding motors and batteries to existing bikes. The company launched its first commercial model, the RadRover, by starting a crowd-funding campaign on Indiegogo in April 2015 to raise money for a $1499 fat tire e-bike with 26×4″ tires, a front suspension fork and a 500W motor with steel gears. Few e-bikes at the time offered fat tires, and the RadRover was dramatically cheaper than competing mountain e-bikes. The company then popularized the long-tail cargo e-bike when it released the RadWagon in the same year, and followed those models with the folding RadMini and RadCity for commuters in 2016 with a starting price of $1499.

Unlike the traditional bicycle manufacturers such as Giant, Trek, Merida/Specialized and Pon Holdings/Cannondale, which made expensive e-bikes for recreation and exercise, Rad Power gave riders an upright sitting position that was more comfortable (but less aerodynamic) and provided powerful 750 watt motors (which are the legal maximum in 16 US states) for economical prices that undercut the competition. Radenbaugh says, “We popularized fat tires on e-bikes, throttles on e-bikes, big batteries, lots of power, universal front and rear racking systems, e-bikes that are designed to replace cars.” These practices helped turn Rad Power into the largest seller of e-bikes in the North America and the biggest of the e-bike startups, bypassing the Holland-based VanMoof in 2021 in terms of market capitalization and sales. According to Mordor Intelligence, Trek has more sales by revenue than Rad Power in North America, but Trek sells more expensive e-bikes, so it can sell less volume.

Phoenix-based Lectric followed the same playbook and is now disrupting Rad Power with the same direct-to-consumer model. Lectric launched its XP 20″ fat tire folding bike in 2018 for $999, which was $500 cheaper than the $1499 RadMini. It offered better service to its customers than Rad Power, and convinced many bike shops to also sell its bikes. Lectric’s XPeak mountain bike and Xpedition cargo bike also undercut the price of the RadRover and RadWagon. Lectric has now supplanted Rad Power’s reputation, as the place to buy decent-quality, entry-level e-bikes.

In 2021, Rad Power raised $304 million in venture capital with big plans to expand into Europe, triple its retail locations and mobile service locations by the end of 2022, and move production from China to North America and Europe. However, the company announced in July 2023 that it would be pulling its operations out of Europe and the UK, which was only a week before VanMoof declared bankruptcy. Rad Power, which was gaining a reputation for poor customer service, was hammered by a reputational loss, when it had to recall nearly 30,000 of its Radwagon 4’s in November 2023 due to faulty rims that caused tire punctures. Rad Power is now struggling to remain profitable in the face of new competitors that are undercutting its prices. In January 2024, Rad Power announced massive price cuts between $100 and $1000 on all its models, dropping its RadRover 6 Plus from $2099 to $1599 and its RadTrike from $2499 to $1499 to compete with Aventon’s Aventure.2 and Lectric’s XP Trike.

Nonetheless, the Seattle-based company seems to have made a strategic decision that it can no longer compete at the low-end of the market. It has raised its prices and its specs with its new 2024 models, seeking profitability rather than larger market share. With the Rad Expand 5 Plus ($1899), Rad Trail ($1999), Rad Road ($1999) and RadWagon 5 ($2199), Rad Power is hoping that its customers will pay extra for new features, such as more powerful motors with more torque, ability to go 28 mph with pedal assist (class 3), hydraulic disk brakes, eco-packaging, torque sensors, turn signals, stronger headlights, NFC key fobs, self-resetting fuses and heat-absorbing resin around each cell to prevent thermal runaway in its batteries.

It is questionable how long Lectric will remain the disruptor in the American market. Aventon, Velotric and KBO are all nipping at Lectric’s heels, often offering models with better components, which are only slightly more expensive. For example, Aventon offers torque sensors in its bikes, which many riders prefer to Lectric’s PWR cadence sensors, and Aventon, Velotric and KBO all offer cargo bikes with front suspension forks, whereas Lectric’s Xpedition has no suspension.

The fierce price war between the direct-to-consumer e-bike brands has driven down the price of e-bikes in the U.S., which have made e-bikes accessible to many Americans who previously couldn’t afford them. The dropping prices in the American market help to explain why e-bike sales are now growing so much faster in the US than in Europe, where prices have remained far higher.

Another reason for the falling prices is the entrance of numerous Chinese brands that sell on Amazon and eBay for prices starting as low as $400. They offer bigger batteries and higher watt motors for incredibly low prices, but most of them don’t have any bricks and mortar sellers, and they only sell a limited number of replacement parts from their web stores, so it is a crap shoot whether replacement parts can be found for them. In theory, most parts are generic enough that replacing them isn’t a problem, but most people will likely end up junking these Chinese-branded e-bikes when they break.

Although these Chinese brands don’t have a reputation for quality, their quality isn’t necessarily bad. For example, Lectric is rumored3 to have its e-bikes built by Galaxy Bicycle, which is a bike OEM/ODM based in Guangdong, China, whose 20,000 m2 factory has the capacity to build 150,000 e-bikes and 600,000 manual bicycles per year. In 2023, Galaxy Bicycle launched the AiPAS brand, whose A2, M2 and A6 models look like they come from the same designer as Lectric’s XP, Xpeak and Xpedition, respectively, yet they cost several hundred dollars less. What is clear is that companies like Lectric and Aventon are only able to offer such low prices in the US because their e-bikes have low manufacturing costs in China. Aventon was founded by a Chinese immigrant in Southern California and the company runs its own factory near Shanghai.

The Taiwanese bicycle companies Giant, Merida and Ideal Bike started out as OEMs that manufactured bikes for other companies in the 1970s and 1980s and then launched their own brands to sell in Western countries. They mastered building higher quality bikes in Taiwan and lower priced models in China and selling them to the rest of the world under their own brand names. It is likely that many of the Chinese bike OEMs/ODMs will attempt to follow a similar path, as Galaxy is currently trying to do with AiPAS, since there is an easy route to sell directly to Western markets through online platforms like Amazon.

The question is whether these Chinese brands can convince bricks-and-mortar bike shops to support their bikes, because many consumers will be reluctant to buy a bike if there is nowhere to test ride it and get it fixed. Judging from AiPAS, which has only convinced a handful of bike stores to sell its models around Los Angeles, central Florida and Detroit so far, it appears unlikely that many of the new Chinese brands will have much success breaking into the American market, and the European market appears to be even harder to crack.

There are YouTube channels, like HappyTailTV, Electric Vehicles Space, Electrified Reviews, E-Ryders, etc., that are willing to review these Chinese models because they give out discount links where the reviewer gets a few bucks when customers buy the bikes. However, the more respected reviewers won’t cover them and many of these Chinese companies appear to be inept at using social media and advertising in Western markets to build their brands. The first step is to hire someone to write good product descriptions in English to sell on Amazon, and many of them don’t even get that part right.

An example is the Likebike brand owned by Hong Kong Laike Sports Equipment Co. The brand started with a Kickstarter crowdfunding campaign in July 2018 to create “the coolest and most affordable ebike!” Today, Likebike offers the cheapest adult e-bike on Amazon with a UL certified battery. The Likebike Cityfun S is a 20″ fat tire folding bike with a 500W motor and front suspension fork which costs $399.99, which is an amazing price considering its componentry. However, there are over a dozen grammatical errors and awkward phrases in its product description, that make it hard to read. Even overlooking the lack of spaces after punctuation, run-on statements and capitalization problems, the end of this description is downright confusing:

Powered by a 48V 10.4AH high performance battery,removable battery lets you can take your battery to the charging center without the extra burden of moving your bike,fast charging technology allows you to complete a charge in only 4-5 hours, reducing waiting and enjoy riding fun.we also guarantee the safety of the battery, is protected by BMS intelligent safety.Long mileage:Electricity-only 3-speed:33.6 miles. (highlighting mine)

Many readers will assume that “3-speed” means that it has 3 gears or 3 levels of pedal assistance, until they read further in the description to find that it has 7 gears and 5 levels of pedal assistance. However, that still leaves the question whether this means that it gets 33.6 miles of range using only the throttle or does it mean 33.6 miles with the pedal assistance set at level 3? Maybe it has three speeds in throttle mode (what is called “electricity only” mode). It is not at all clear what Likebike is trying to say.

Likebike clearly doesn’t know how to advertise on social media, since its Facebook account is “not available” and it isn’t even possible to see if its 2018 crowdfunding campaign was a success, since it made the last 14 updates private for backers only. Its only social media account is Youtube, which has 29 subscribers and just consists of instructions for assembly and configuring its display. The assembly video for the Likebike Cityfun S has only been viewed 634 times and all three of the comments on the video highlight the problems with the company’s lack of a media strategy:

@Djlicious509

Why cant i find any reviews with anyone other than you guys? Does no one ride them?

@pauldistefano670

I was just thinking the same thing I cant find them anywhere!

@davidbatin1699

This bike is similar to AiPas A2 folding bike but way cheaper at $399 to Aipas A2 [at]$719. I wonder why that is & is it worth buying.

Likebike hasn’t even bothered sending its bike to Youtube bike reviewers or handing out discount codes to pay reviewers who generate sales for them. The Likebike web site says that there is a Likebike Reward Program for people who post on social media about Likebike, but a Google search doesn’t find anyone who has bothered to post about the company’s products. Instead, it turns up over a dozen places on the Internet using the name “Likebike”, including a bike shop in Portugal, a scooter/bike store in Hungary, a Russian store selling fat tire kick scooters, a bike rental company in Ireland, another bike rental company in Spain, an X account that talks about bikes, a bike seller in Poland who blogs about healthy eating, a bike exposition show in Monte Carlo, etc., and many of them are better publicized than Likebike from Hong Kong.

The only thing the company has going for it is rock-bottom prices, but few people are willing to take a risk on a product that has no brand reputation and no way to get replacement parts. At its current prices, the company is probably selling the Cityfun S at a loss on Amazon. Maybe it is using low prices in an attempt to break into the market, but the company didn’t allocate a budget for advertising, social media and sending out test bikes for review, so it is doomed to fail if this is an attempt to establish the brand’s presence in the market. Given that the brand’s web page is advertising higher prices than on Amazon, it isn’t even a coordinating strategy to get customer’s attention with its low prices, so it looks more like a fire sale to clear out the stock. None of this gives much confidence that the brand will be around for very long, which is the case for most of the Chinese e-bike brands selling on Amazon.

There are some Chinese e-bike manufacturers, such as Ancheer, that are such large OEMs/ODMs, that they have the volume to compete at rock-bottom prices, and they may be successful at selling their own branded e-bikes, even without selling in physical stores and building up a repair network for its bikes. The one exception to Chinese companies doing badly at building their brands in the West appears to be Shenzhen Engwe Smart Technology Co, whose Engwe brand is establishing a foothold in Europe. It focuses on low prices to gain market share, but it also makes a number of very distinctive moped-style e-bikes that have garnered it quite a bit of attention. The Guangdong-based company has 3 bike factories in China and US$300 million in annual sales. It has established a repair network with 53 bike shops in Europe and 3 in the US where its bikes can be fixed.

The developing world

A common assumption is that bicycles are widely used in the so-called “developing world” as a means of transportation, because they are much cheaper than other forms of transport, but the reality is that bicycle usage is generally higher in the so-called “developed world,”4 especially in urban areas. Scooters and motorcycles from China and India have become so inexpensive that many people in the developing world are riding motorbikes rather than bicycles. In addition, the export of Chinese automobiles in recent years has dramatically lowered the cost of buying a new car in many developing countries. Whereas Japanese cars used to dominate the auto markets in Africa, Latin America and much of Asia due to their reputation for reliability, the Chinese automakers have undercut the prices of Japanese brands, so that China bypassed Japan in 2023 as the largest exporter of automobiles in the world. Most of the Chinese auto brands haven’t been able to gain a foothold in North American, European, Japanese, South Korean or Australian markets, so they are only exporting to the developing world.

Most people in the developing world who want private transport are not recurring to bicycles, but to motorbikes and automobiles. According to the sales data at Statista.com, Western Europe, the US, Canada, Australia, New Zealand, Israel, Singapore and Japan together bought an average of 39.7 new bicycles for every 100 persons between 2015 and 2022. If China is excluded, since it arguably is becoming part of the developed world, the developing world bought an average of 5.4 new bicycles for every 100 persons over the same time period. In other words, people in the developed world are 7 times more likely to buy a new bicycle than people in the developing world. The average number of new bikes sold between 2015 and 2022 per 100 persons was 1.43 in Africa, 1.71 in Central America, 10.15 in South America and 8.53 in Asia (excluding China).5

Bicycles are likely have a longer lifespan in developing countries, since bikes are more likely to fixed and upgraded due to the lower labor costs, which make it far cheaper to repair a bike than buy a new one. On the other hand, it is often difficult to get replacement parts for bicycles which don’t have generic components in developing countries, so many bicycles get needlessly junked. Even after trying to account for greater sales of used bikes and longer lifespans of bikes, the low sales numbers indicate that bicycles simply aren’t a popular medium of transport in most of the developing world.

This limited usage of bicycles matches my own personal observations from traveled through 20 Latin American countries over the last 25 years. In none of the countries that I have visited have I seen widespread usage of bicycles like in Northwestern Europe. Most Latin American children do learn to ride a bike, but it generally gets abandoned as they grow older in favor of motorbikes, cars and pickup trucks. In most Latin American cities, it is not common to see large numbers of adults riding bicycles, and most riders are young men. It is rare to see bicycle riders commuting to work or carrying groceries in Latin American cities, whereas people commonly do those activities with motorbikes. In rural parts of Latin America, nearly every house has a motorcycle parked outside. These aren’t the expensive heavy cruisers popular in North America, but light motorcycles which don’t require much gasoline and are capable of riding through muddy and unpaved roads. Likewise, in the Asian countries I have visited, I saw gasoline scooters being used everywhere as a practical means of transport.

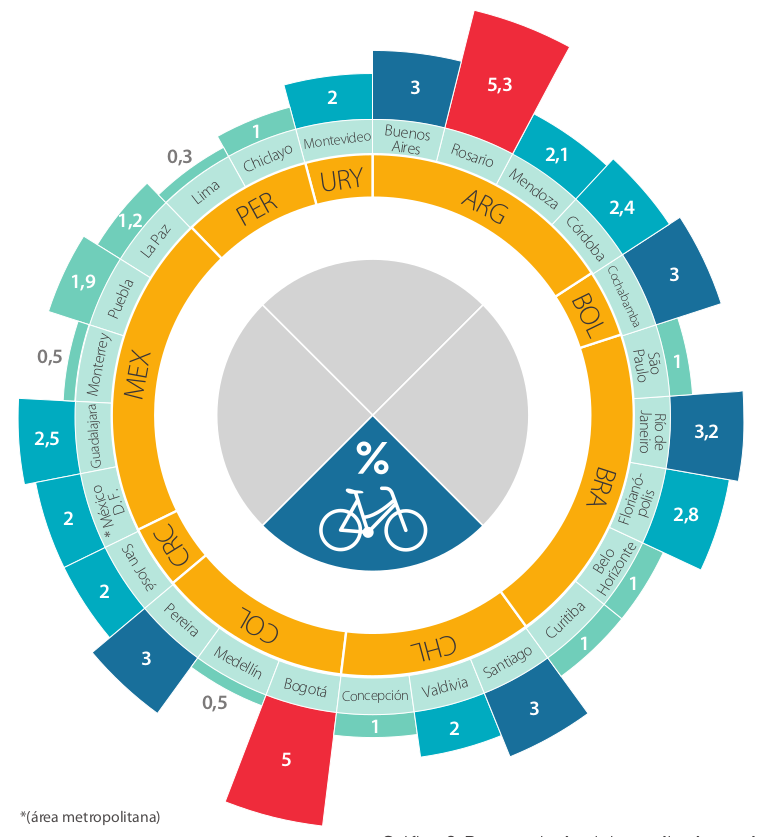

The Inter-American Development Bank (IDB) conducted a study in 2014 of cycling in Latin America, and found that there was a wide variety in the use of bicycles between different cities. One percent or less of trips were made by bicycle in cities such as Monterrey, Lima, São Paulo and Medellín, whereas 3 or more percent of trips were made by bicycle in cities such as Buenos Aires, Rio de Janeiro and Santiago.

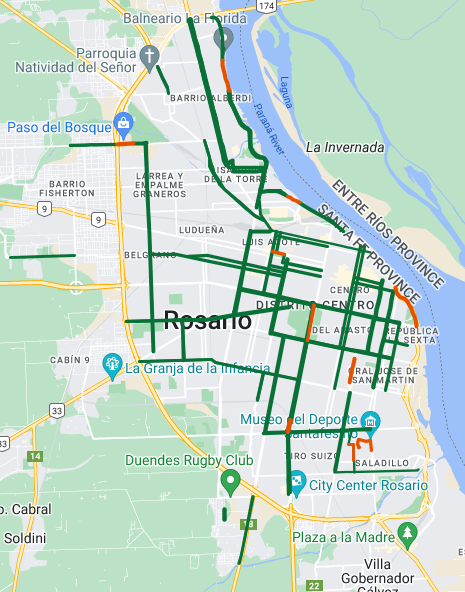

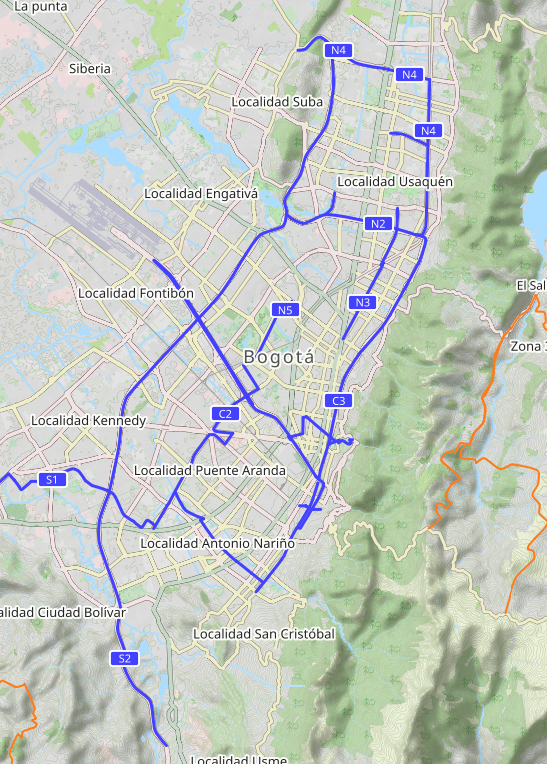

Rosario with 5.3% and Bogota with 5% of trips by bicycle were dramatically better than other Latin American cities. Both cities have a temperate climate that permits cycling all year around, and they have flat centers of their cities that are dense, because they were designed before cars, which facilitates cycling. In addition, Rosario has roughly 100,000 university students, which increases the number of likely riders. Bogota with 7.2 million inhabitants is generally not considered a progressive city. It is the 10th worst city in Latin America in terms of air pollution, and deals with high levels of inequality and social disparities as people crowd into shanty towns on the outskirts of the city.

The key difference, however, is that both Rosario and Bogota have constructed good networks of biking paths that connects most of the city center. Rosario implemented its Integrated Mobility Plan of 2010 which has expanded the number of biking paths from 35 km to 196 km and its public bike sharing program now consists of 613 bikes that can be parked at 84 parking stations through out the city, which is used by 125,020 riders.

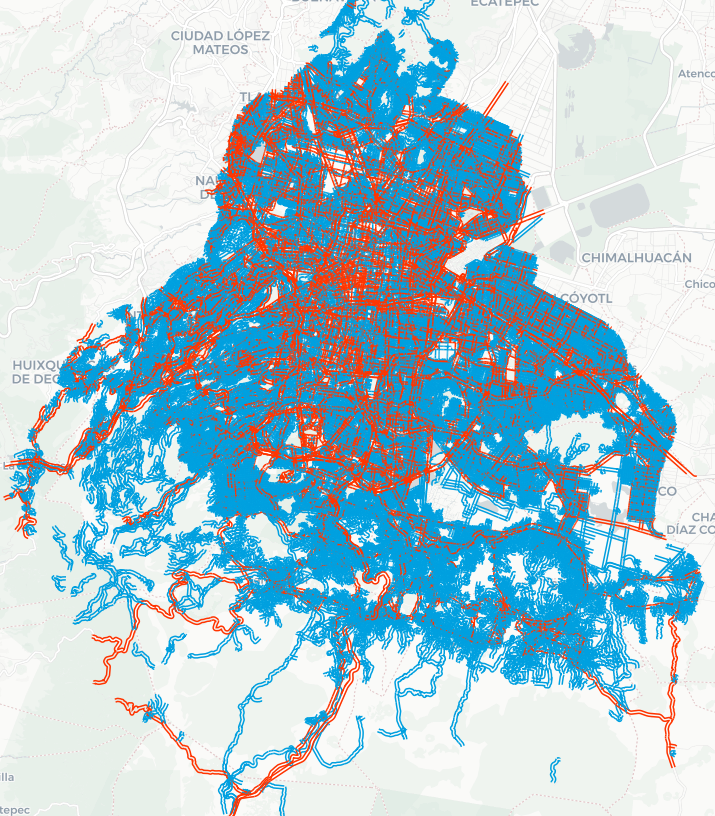

Bogota built its first cycling path in 1974, but it didn’t get serious about promoting cycling until 1995-2000, when the city expanded its cycling routes from 20 km to 121 km. Today, the city boasts that its cycling network connects 19 of the 20 regions of the city. In June 2021, Bogota’s mayor announced, “In Bogota, we feel very proud to be the world bike capital, already having more than 560 km of biking paths, and in the next 4 years we are going to construct 300 more to get to more than 800, with the best infrastructure, better lighting, better connected, so that we may be not only a medium of biohealthy transport, but also a lifestyle.” In September 2022, the Brazilian company Tembici started its public bike sharing program in Bogota, which now consists of 1500 mechanical bikes, 1500 e-bikes, 150 box bikes (bakfeits) and 150 hand powered bikes for wheel-chair users, which can be parked at 300 stations.

Bogota has constructed the largest network of cycling paths of any city in the Americas. At 608 km in length, Bogota’s cycling network is now larger than the cycling networks in Amsterdam and Copenhagen, which are ranked by the Copenhagenize Index as the two best cycling cities in the world. Of course, Bogota has 5 times more people than those cities, so it has less infrastructure for cyclists per capita. Bogota has 76.6 meters of bicycle path per 1000 inhabitants, whereas Copenhagen has 399.6 and Amsterdam has 352.9 m. per 1000 inhabitants. There are other Latin American cities which have more meters of bicycle path per capita than Bogota, but many of those cities haven’t done a good job of connected together their cycling paths to provide comprehensive coverage of the city. Many bicycle paths were constructed for recreation and weren’t designed to connect to other parts of the city and get people to the places that they need to go for work, school, shopping, etc. Clearly, Latin American cities have a long way to go to match the cycling infrastructure of the best European cities, but Bogota demonstrates what cities in the developing world can do to promote cycling when there is political will.

| Bicycle paths per country/city | |||

| Country/City | Paths (km) | Population | meters per 1000 persons |

| Argentina | |||

| – Buenos Aires | 272 | 3 121 707 | 87.1 |

| – Rosario | 196 | 1 198 528 | 163.5 |

| – Mendoza (metro) | 110 | 937 154 | 117.4 |

| Bolivia | |||

| – Santa Cruz | 79.5 | 1 903 398 | 41.8 |

| – Cochabamba | 33.04 | 841 276 | 39.3 |

| Brazil | 4365.79 | 215 313 498 | 20.3 |

| – São Paulo | 689.1 | 12 396 372 | 55.6 |

| – Brasília | 636.89 | 2 817 381 | 226.1 |

| – Rio de Janeiro | 487 | 6 211 423 | 78.4 |

| – Fortaleza | 419.2 | 2 428 708 | 172.6 |

| – Salvador de Bahía | 306.64 | 2 417 678 | 126.8 |

| – Curitiba | 245.7 | 1 773 718 | 138.5 |

| – Recife | 174.3 | 1 488 920 | 117.1 |

| – Florianópolis | 131.86 | 537 211 | 245.5 |

| – Belém | 116.5 | 1 303 403 | 89.4 |

| – Belo Horizonte | 105.78 | 2 315 560 | 45.7 |

| – Campo Grande | 103 | 898 100 | 114.7 |

| Colombia | |||

| – Bogota | 608 | 7 936 532 | 76.6 |

| – Cali | 192 | 2 250 842 | 85.3 |

| – Medellín | 120 | 2 611 104 | 46.0 |

| – Manizales | 107 | 434 006 | 246.5 |

| – Barranquilla | 63.1 | 1 326 588 | 47.6 |

| Chile | 2072 | 19 603 733 | 105.7 |

| – Santiago | 781 | 6 254 314 | 124.9 |

| Ecuador | |||

| – Quito | 163.58 | 1 763 275 | 92.8 |

| Guatemala | |||

| – Cuidad de Guatemala | 30 | 1 221 739 | 24.6 |

| Mexico | 2733.9 | 127 504 125 | 21.4 |

| – Cuidad de Mexico | 316 | 9 209 944 | 34.3 |

| – Querétaro | 307.9 | 794 789 | 387.4 |

| – León | 293.5 | 1 579 803 | 185.8 |

| – Guadalajara | 253.2 | 1 385 621 | 182.7 |

| – Aguascalientes | 230.2 | 863 893 | 266.5 |

| – Mérida | 212.6 | 921 771 | 230.6 |

| – Hermosillo | 180 | 855 563 | 210.4 |

| – Puebla | 150.9 | 1 542 232 | 97.8 |

| – Zapopan | 123.4 | 1 257 547 | 98.1 |

| – Torreón | 86.9 | 690 193 | 125.9 |

| – Cuidad Juárez | 65 | 1 501 551 | 43.3 |

| Peru | |||

| – Lima (metro) | 323.43 | 10 092 000 | 32.0 |

| Uruguay | |||

| – Montevideo | 67.79 | 1 305 082 | 51.9 |

| Europe | |||

| Netherlands | 35000 | 17 564 014 | 1992.7 |

| Berlin | 3000 | 3 755 251 | 798.9 |

| Copenhagen | 546 | 1 366 301 | 399.6 |

| Amsterdam | 515 | 1 459 402 | 352.9 |

| Source: compiled by Amos Batto | |||

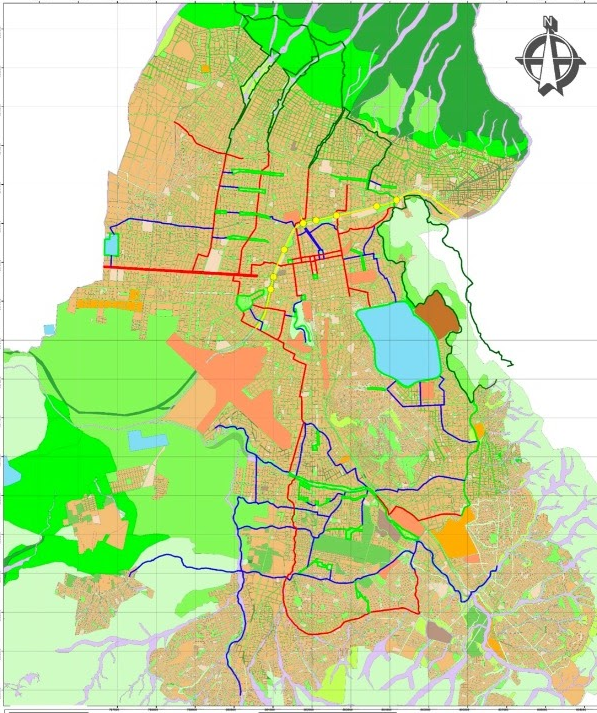

Another city which has great ambitions to develop its cycling infrastructure is Cochabamba. Manfred Reyes, Cochabamba’s mayor in the 1990s who had visited his compatriots working in the Washington DC area, was inspired by the parks and cycling paths that he saw in the American capital. Reyes strove to implement similar features in his city, building new parks and the first two bike paths in the city starting in 1995. Today, Cochabamba boasts 33 km of biking paths, but Reyes, who was reelected as mayor in 2021, has announced an ambitious plan to build 200 km of additional cycling paths throughout the city, including “supercycle” corridors to connect the 6 zones of the city and its outlying areas. Reyes traveled to Richmond to learn how Virginia’s capital city had a “successful implementation of cycling routes, traffic lights, and routing infrastructure with cutting edge technology” which the mayor characterized as an “important transference of knowledge about intelligent cities, modernization of services to citizens and urban planning.” It remains to be seen whether Cochabamba will be able to implement its “Open Streets” initiative to “prioritize pedestrians and cyclists over automobiles”, given that the GDP of the Cochabamba region is only US$3049 per capita, but it illustrates that the chief limitation is not resources, but lack of political vision.

What is striking is the major differences that the IDB study found in bicycle usage between cities in the same country. What explains the disparity between Bogota with 5% of trips by bike vs Medellín with 0.5% of trips by bike? Likewise, why is São Paulo at 1% vs Rio de Janeiro at 3% in Brazil, Monterrey at 0.5% vs Guadalajara at 2.5% in Mexico, and Concepción at 1% vs Santiago at 3% in Chile? To some degree these differences in bike usage can be explained by geography, climate and when the cities were developed.

Some parts of Medellín are so steep that it is virtually impossible to ride a bicycle in some neighborhoods which are built into the sides of mountains. There are markedly more bicycle riders in El Alto than La Paz, even though they sit right next to each other, because La Paz is built in a steep river valley, so many neighborhoods are only accessible via steps and sharp switchbacks, whereas El Alto sits on a flat, arid plain. To deal with their mountainous geography, both Medellín and La Paz have implemented a series of aerial cable cars to carry people up the steep slopes of the city. In Rio de Janeiro, I saw many bike riders in the flat part of the city near the beach, but few riders in the steep favelas above the city.

Hot and muggy climates also hinder bicycle usage. A bike that requires physical exertion is less enjoyable to ride when people are already sweating from the heat. In Bolivia where I have lived since 2007, I notice a huge difference in the number of bike riders in temperate Cochabamba which has an average temperature of 15.3 °C and average humidity of 65.2%, compared to muggy Santa Cruz which averages 23.2 °C and 70.3% humidity. It is far more pleasant to cycle in Mexico City which averages 16.0 °C than Monterrey which averages 21.3 °C. However, the climate doesn’t explain everything. Guadalajara averages 20.9 °C, yet the IDB study found that it has a higher percentage of trips by bike than both Monterrey and Mexico City.

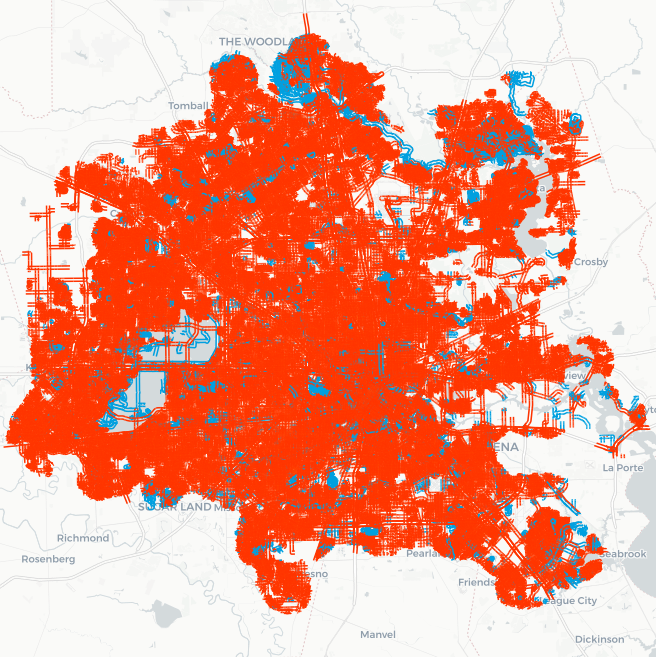

Another factor is whether the city was mostly designed before or after automobiles came to the fore. Cycling through a compact city center designed for the horse and buggy is a far better experience than trying to cycle through a dispersed city designed for automobiles, which probably explains why people in Guadalajara are 5 times more likely to travel by bike than people in Monterrey, which is mostly a new city constructed primarily for automobiles. Likewise, São Paulo is a sprawling city designed for cars, whereas Rio de Janeiro is an older and more compact city where sprawl is limited by the hills around the city. In theory, cities like São Paulo and Monterrey should be good places to cycle, since they are flat, but the large distances and the high-speed roads designed for cars often make bicycles impractical. Cyclists often cannot find safe cycling routes through a city when it is cut up by high speed roads. However, the situation is often better in the developing world than in places like the US, Canada and Australia, since there are many more people on foot and riding buses, so there is often a way to cross the high speed corridors and drivers are more accustomed to dealing with slower moving vehicles on the sides of busy roads.

The important aspect of e-bikes is that they can help overcome many of these hindrances to manual bicycles presented by geography, climate and streets designed for automobiles. An electrical motor now makes it possible to ride a bike through the same terrain as a motorcycle, which opens up bicycle usage to hilly places and mountainous cities like Medellín and La Paz. Having a motor which is capable of going up steep inclines allows ordinary people who aren’t Tour de France cyclists to ride their bikes to many places that were formerly relegated to vehicles with internal combustion engines. Now that many e-bikes are being sold with wide tires, stronger rims and spokes, better hydraulic disk brakes and beefier frames, rural people in the developing world are more likely to ride them over rough country roads and through rugged terrain where motorbikes were considered necessary.

The climate is another important factor which limits the use of the traditional bicycle. In hot and muggy places like India and Brazil, where people commonly use motorbikes instead of bicycles today, e-bikes will allow people to limit their physical exertion, so they don’t have to arrive hot and sweaty at their destination. The 2017 survey of North American cyclists found that 31.6% listed not liking “to arrive sweaty” and 15.8% listed “weather conditions” as “barriers that limited utilitarian riding”. The higher speeds of an e-bike provides moving air which cools the body while riding and dries the sweat. A survey of e-bike riders in Hangzhou, China found that 49.6% report that work is their main purpose for riding their e-bike, despite the fact that Hangzhou has an average high of 33.1C (91.6F) in July, as well as an average humidity of 75%. In places that get lots of rain or snow/ice, the wider tires, lower tire pressure and fenders, which are becoming common features on e-bikes, make them safer to ride on wet and icy roads.

E-bikes can also help overcome some of the disadvantages of living in a place designed for cars where traveling long distances is often required. The Hangzhou survey found that 32.1% of e-bike riders have average rides of between 30 minutes and an hour and 9.4% have average rides over an hour long. Riding such long distances is not feasible for ordinary riders with a manual bike, but an e-bike can dramatically extend riding distances.

Just as important, an e-bike allows riders to keep up with the motorized traffic in cities designed for cars. Although crashes at higher speeds are more dangerous, the survey of North American cyclists found that 78.3% feel safe riding an e-bike, compared to 63.7% on a manual bike. As one e-bike rider explained, “One of the safety advantages is that since I can ride faster, in traffic I often feel safer going closer to the flow of traffic in stop and start situations. Another advantage is with a motor, when stopped at a light I can ‘get off the line faster’ thereby not feeling as vulnerable to a car behind you.”

Although e-bikes would seem to offer many advantages to people in the developing world, their sales have varied widely in the developing world. According to Statista, in 2022 e-bikes represented just 2.8% of bicycle unit sales in Mexico, 1.6% in Central America, 1.9% in South America. Statista doesn’t report sales in Africa, but they appear to be very low there as well. In contrast, e-bikes represented 75.5% of bicycle unit sales in China and 21.9% in Europe in 2022. Some parts of Asia are adopting e-bikes very quickly, whereas other parts are not. E-bikes represented 17.5% of bicycle sales in Turkey in 2022, 16.5% in the Philippines,12.6% in Indonesia, 11.4.% in Singapore and 9.1% in Vietnam. E-bike usage in these countries is following Europe’s trend. However, Statista reports that e-bikes represented just 1.6% of the bicycle market in India in 2022, and the situation appears to be the same in Pakistan, Bangladesh, Iran, etc.

Nonetheless, there are signs that e-bike sales are going to take off in places where they are currently very low. For example, Brazil’s Aliança Bike, which represents Brazil’s bike manufacturers, reports that e-bike sales have grown at a good clip from 7600 units in 2016 to 44,830 units in 2022. Although e-bikes are currently 1.9% of Brazil’s bicycle unit sales, they will become a significant part of the market if they continue growing at a rate of 50% per year. Likewise, India’s e-bike sales have grown from 6500 bikes in 2019 to 231,338 bikes in 2022. If this explosive growth continues, e-bikes will become a major force that revolutionizes micro-mobility in the developing world.

Even though Statista and Mordor Intelligence only foresee moderate growth of e-bikes in the developing world, there are a number of reasons to believe that e-bikes will be widely adopted and encroach on the markets for ICE scooters and motorcycles in many developing countries. Chinese e-bike brands are starting to arrive in many markets in the developing world. Unlike the traditional bicycle companies, such as Giant, Trek, Merida/Specialized, Accell Group, Pon/Cannondale, etc. which are focused on the high-end fitness market, many of the Chinese brands are now focused on selling to people who need an economical means of transport.

I saw this evolution occur in Bolivia where I live. The first Chinese e-bikes that I saw arrive in the Bolivian market were expensive mountain bikes in 2017 and 2018. They cost well over US$1000, and were only sold in a few high-end bike stores. By 2020, cheaper mountain bikes started appearing that cost around $650 with brand names like “Land Rover”, which indicated that they weren’t too worried about a trademark violation with the Landrover auto company. However, the type of e-bike that has proven to be most popular in Bolivia is a 20 inch city bike with an extra back seat, a wide floorboard and a front basket, which sells for about $500. I started seeing these bikes on the streets of El Alto during the COVID-19 pandemic, and they are now common on the streets of Cochabamba. The second type of e-bike which has found a good market in Bolivia are scooter-like bikes with 12 inch wheels and thick floorboards whose pedals are mainly for show, so they don’t need a license to be ridden. They can be found for $400 – $500, which is competitive with similar sized ICE scooters.

I haven’t seen many fat tire or folding e-bikes for sale in Bolivia, but I think they will start arriving soon due their popularity in North America. The one Chinese brand which is now exporting those types of bikes to Bolivia is Jinghma and I have seen a couple of its R8 models on the streets of Cochabamba, where it now sells for $615. Once more folding fat-tire e-bikes start arriving in Bolivia, I expect that they will prove very popular.

It is hard for me to estimate how many e-bikes are being sold in Bolivia and what percentage they occupy of the bicycle market, but I know that it is far higher than the 1100 units sales and 1.3% market share that Statista estimated in 2022. Like most electronics in Bolivia, I assume that most e-bikes are imported through black markets that evade customs so they don’t get counted in the official statistics.

Unlike in Europe and North America, where Chinese brands have trouble selling their vehicles, they have no trouble finding buyers in Bolivia. While Bolivians will tell you that Toyota automobiles and Honda motorcycles are the best brands to buy, they are very wiling to buy Chinese automobiles and motorcycles, which now dominate the new car and motorcycle markets in Bolivia. The last time I went to the motorcycle markets in La Paz and Cochabamba, I saw 10 Chinese-branded bikes for every 1 Japanese-branded one. When I recently visited bicycle stores in Cochabamba, I didn’t see a single e-bike for sale that didn’t come from a Chinese brand. I can’t find any reviews online for the Chinese e-bikes I have seen for sale in Cochabamba, but Bolivians generally don’t read reviews before buying a bike. They don’t expect to be able to order accessories online from the brand of bike that they buy and they generally don’t expect to use a brand’s services after sale.

Unlike the Taiwanese, American and European bicycle brands, the Chinese brands are willing to make utilitarian e-bikes, which cater to the Bolivian market and fit within the Bolivian budget. Giant, Merida, Trek, Accell and the other major bicycle companies simply aren’t willing to sell e-bikes that cost $500, but Chinese brands are, which is why I expect Chinese companies to dominate in the developing world. I suspect the reason why e-bike sales are so low in India is because India has largely kept out the Chinese brands, whereas e-bikes are growing fast in countries that have allowed in Chinese imports, such as Russia, Turkey, the Philippines, Indonesia and Vietnam.